5 Things Kuching Startups Must Know That Make Investors Say “Yes”

Sarawak’s startup ecosystem is steadily evolving, driven by innovation in technology, agriculture, and sustainability. In Kuching, especially, we’re seeing more entrepreneurs step forward with bold ideas aimed at solving local and regional challenges. Yet, even with promising ventures on the rise, funding remains one of the biggest hurdles. What’s going on exactly? The truth may surprise you. The reality is that many founders simply don’t know what investors are really looking for. If you’re a startup founder in Kuching aiming to secure capital, whether through private equity funds, venture capital, or strategic investors, understanding their expectations is half the battle. This guide breaks down 5 key things investors want to see, so you can build confidence and increase your chances of saying “yes” to the right funding partner.Table of Contents

|

#1 – A Problem Worth Solving—With a Market That Cares

It all starts with a meaningful problem. Investors don’t just back cool ideas. They invest in solutions that solve real, validated problems for real people. In Sarawak, this could be anything from improving digital access in rural areas to creating eco-friendly alternatives for agriculture. But it’s not enough to have the “what”. You need to show who it’s for and why they’ll care.| ✅ Tip: Highlight how your product or service fills a gap in the market. Reference local pain points and show that you’ve done the groundwork (surveys, early feedback, pilot tests, etc.). 📌 Example: A logistics startup solving last-mile delivery gaps in rural Sarawak towns would immediately resonate with investors who know the challenges of the region. |

#2 – Scalability and Growth Potential

A good startup solves a problem. A great one can scale that solution. This is especially relevant in the context of startup capital in Malaysia, where investors want to see scalable ventures that can deliver long-term returns not just within Kuching but potentially across Malaysia or the region. That’s why tech-driven, asset-light, or platform-based models are often appealing. That being said, scalability isn’t just about tech. It’s about having a business model that can adapt and multiply.| ✅ Tip: Show how your solution can serve more customers without a linear increase in cost or complexity. 📌 Example: Agri-tech startups that provide remote monitoring tools to farmers can easily expand from one district to an entire state with minimal overhead. |

#3 – A Strong Team That Can Execute

Here’s a truth most investors will tell you: “They’d rather invest in a great team with an average idea than an average team with a great idea.” Why? Because execution wins. Investors want to see a capable, coachable, and committed team. Whether it’s a technical co-founder, a sharp marketer, or someone who knows operations inside and out, the blend matters. Even if you’re a solo founder, surrounding yourself with advisors, mentors, or joining an accelerator programme shows you’re plugged in.| ✅ Tip: Highlight the strengths of your core team. Show how each person carries their weight and contributes to driving the business forward. 📌 Example: A founder with logistics experience backed by a mentor from an agri-supply chain background brings both operational know-how and credibility. |

#4 – Traction and a Clear Financial Plan

At the end of the day, investors want to know if you’re gaining momentum and if you know how to handle the money you’re asking for. It’s important to have good pitching skills, but don’t overdo it by turning into a “salesman”. Investors appreciate confidence, not overinflated hype. Traction could mean paying customers, active users, media coverage, or signed MOUs. Even if you’re pre-revenue, showing strong demand or a working prototype can go a long way. Your financial plan should explain how much capital you need, how it will be used, and when you expect to hit key milestones.| ✅ Tip: Be clear about your revenue model and unit economics. Avoid vague projections with hockey-stick growth unless you can back them up. 📌 Example: “We’re currently at 500 users, with a 20% month-on-month growth. A RM250,000 raise will be used to build a mobile app and onboard 5 rural districts within 12 months.” |

#5 – Transparency, Vision, and Local Investor Fit

No one expects you to have all the answers. However, investors do expect and appreciate transparency, vision, and strategic alignment.- Be open about your risks, your learning curve, and how you plan to overcome challenges.

- Be realistic about your projections.

- And most importantly, be clear about your long-term vision. Because investors aren’t just buying into your product; they’re investing in where you want to take it.

| ✅ Tip: Align with investors like Big Grain Capital who bring more than capital. We provide regional insights, access to networks, and an understanding of East Malaysia’s market dynamics. 📌 Why It Matters: Local investors know the regulatory landscape, consumer behaviour, and infrastructure better than anyone. That context can mean the difference between delayed growth and strategic acceleration. |

From Idea to Investment: Your Next Step

Sarawak is full of promising founders and startup ideas, but the ones who secure funding are those who do the work to become investor-ready.

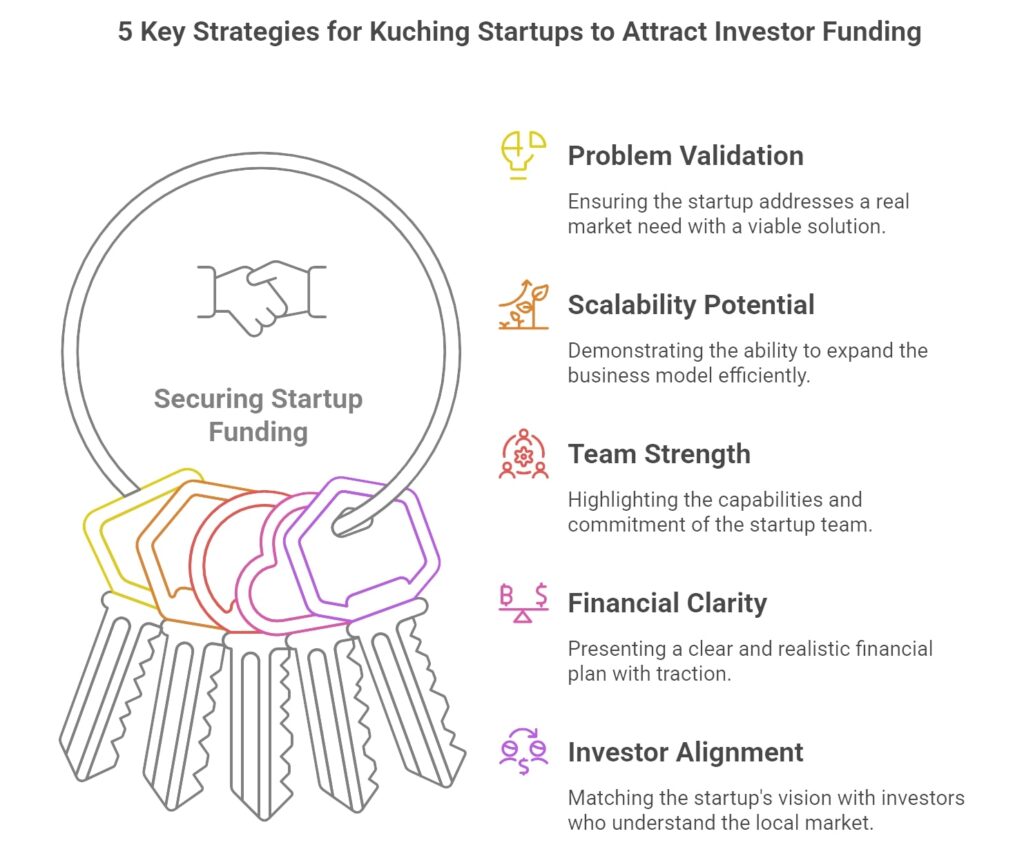

By understanding what matters to investors, from problem validation and scalability to team strength and financial clarity, you’ll be better prepared to stand out from the rest and build trust to strive for the best.

Big Grain Capital is committed to empowering startups in Kuching and beyond with smart capital and local support.

📞 Ready to take the next step? Contact us today for tailored funding solutions and strategic support to grow your startup in East Malaysia.

Sarawak is full of promising founders and startup ideas, but the ones who secure funding are those who do the work to become investor-ready.

By understanding what matters to investors, from problem validation and scalability to team strength and financial clarity, you’ll be better prepared to stand out from the rest and build trust to strive for the best.

Big Grain Capital is committed to empowering startups in Kuching and beyond with smart capital and local support.

📞 Ready to take the next step? Contact us today for tailored funding solutions and strategic support to grow your startup in East Malaysia.